5 Tricks for Mastering Stukent’s Personal Finance Simulation

You’re making $65,000 a year. You have bills to pay, stocks to manage, and sometimes, life happens. All of that responsibility can be stressful.

Use these five tricks to master Stukent Personal Finance (SPF) — and the real world of personal finance.

1. Pay Your Bills on Time

Bills are due every Friday in SPF. You can pay them as early as Monday, so avoid waiting until the last minute. If you make a late payment or miss one altogether, you’ll receive a late fee, and it’ll hurt your credit score.

And, just like in the real world, your financial obligations don’t disappear over the weekend or when you’re on holiday, so don’t forget to pay your bills when you’re not in school.

Use your phone to set reminders or keep notes in a planner to stay in control of your budget and bills.

2. Create Your Own Financial Goals

When it comes to spending money, it can be difficult to exercise control. That’s why you should create your own personal financial goals in the very beginning. In the case of SPF, you should determine the Sim Score you want and how much you are willing to spend on down payments, so you can budget accordingly.

Along with Sim Scores and down payments, you’ll want to plan ahead for major purchases. For example, if you know you want to purchase a house or a luxury vehicle, set the monthly payment amount aside each paycheck. This will allow you to see if you really want to commit to the cost of that house or luxury vehicle before agreeing to purchase.

More importantly, you should set a goal to save money for emergencies. Life happens at unexpected moments, and it’s best to be prepared.

3. Watch Your Credit Score

Remember that your credit score in SPF fluctuates as you make in-class decisions. For example, you’ll be fined for poor attendance, and it will negatively impact your credit score.

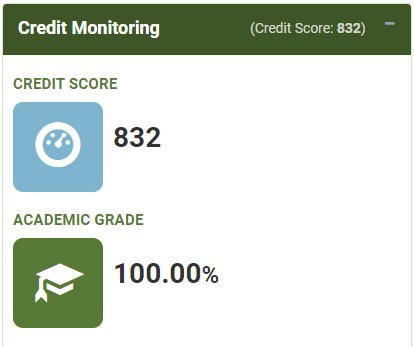

An MPF credit score of 832

You’ll also want to keep a close eye on your credit score because required down payments will fluctuate depending on how good or bad it is.

And as a general rule, don’t use more than 30 percent of your credit limit. Doing so can potentially hurt your credit score. On the other hand, using 1-30 percent of your credit can benefit your score.

4. Invest Early, Often, and for the Long Run

You should invest a small portion of each paycheck in stocks. Once you make those investments, leave them be. Don’t panic if your stocks don’t always perform how you expect. Be patient, and your consistent investments will add up.

Also, don’t put all of your money into one stock. It is safer to spread your investments out in case one stock tanks.

5. Keep Your Emotions in Check

There is a place for emotion in finance, but not at the planning and budgeting stages. If you only spend based on emotion, you’ll run into financial problems. On the other hand, if you think logically and control your emotions, you’ll find a safe, middle ground.

In terms of purchasing things you want, begin by identifying the items you can afford. Then, choose from that list. Don’t identify what you want then pick the most affordable options from there.

Formerly known as Mimic Personal Finance (MPF)

Comments